Private Credit in 2025: Why Banks Are Stepping Back from CRE Loans

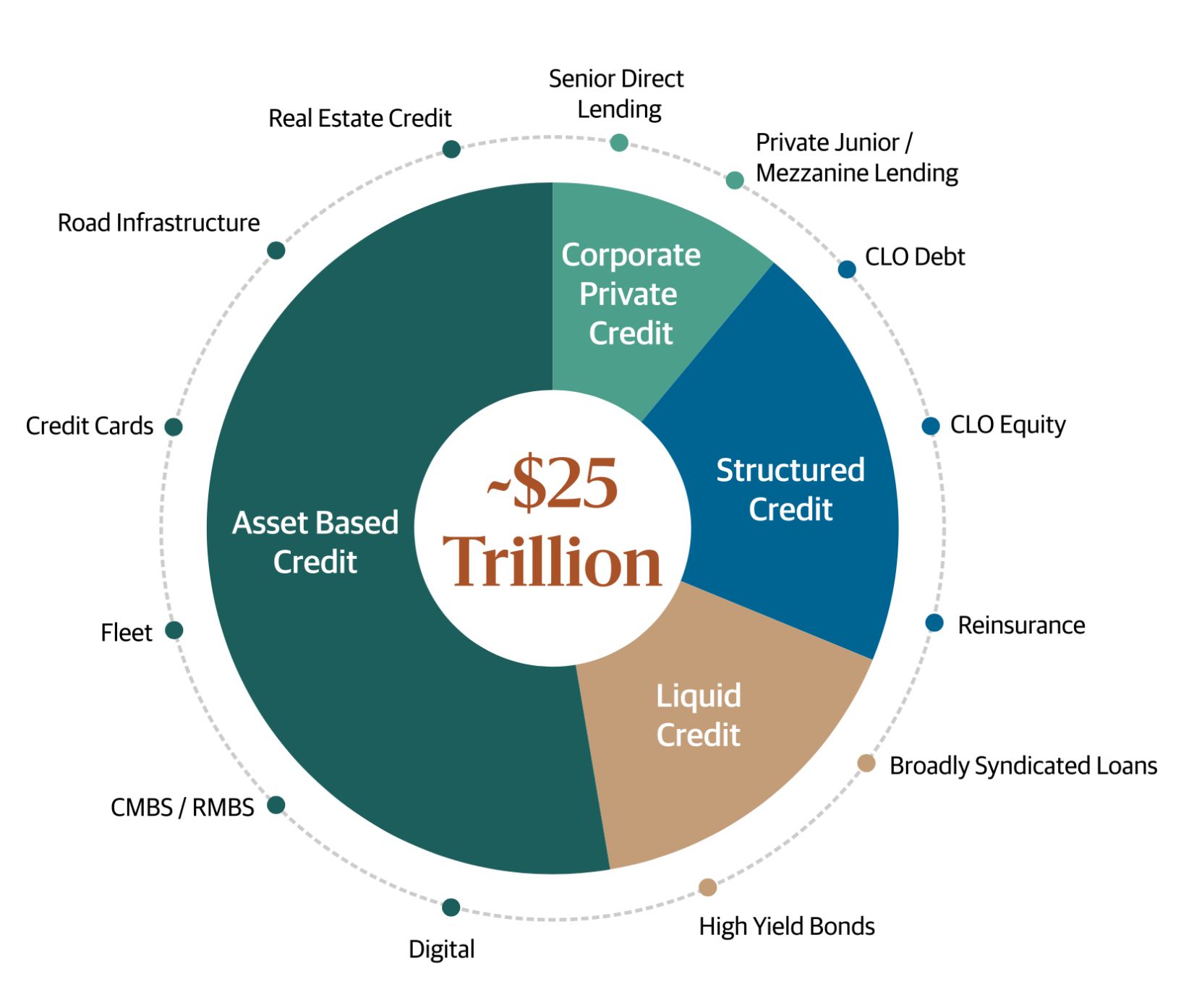

Private credit has become a financial powerhouse with global assets under management reaching US$1.6 trillion in 2023. This growth has altered the map of commercial real estate financing while traditional banks pull back from this sector.

Bank lending dropped from 44% of all corporate borrowing in 2020 to just 35% in 2023. This created a huge gap in the market. Moody's predicts that nonbank lenders will handle more than 10% of the $8.9 trillion commercial real estate market. These changes mark one of the biggest private credit trends we've seen in decades.

Several factors drive this private credit boom while banks step away from CRE loans. Borrowers get more flexible terms through the private credit market than traditional bank loans. They can access customized amortization schedules, fewer covenants, and creative interest payment structures. BlackRock projects the private credit market will grow to US$3.5 trillion globally by 2028. This is a big deal as it means that the value will be higher than today's US leveraged loan and high-yield markets combined.

This piece will get into why banks are moving away from CRE lending, how private credit fills this gap, and what this fundamental change means for commercial real estate financing's future.

Why banks are pulling back from CRE lending

Banks are stepping away from commercial real estate lending faster than ever in the last few years. This makes sense given the challenges traditional lenders face in the CRE space. Banks' retreat creates big opportunities for private credit providers to step in and fill the financing gap.

Tighter regulations and capital requirements

Banking regulators now watch CRE lending more closely. They keep a strict eye on banks that have too many of these loans. From 2018 to 2023, regulators flagged between 335 and 437 banks for extra scrutiny due to their CRE loan levels. The numbers peaked in 2023. Regulators worry about banks that invest too heavily in commercial property.

The FDIC, Federal Reserve, and OCC team up to monitor CRE lending through on-site checks and remote surveillance. Their 2006 guidelines set certain thresholds that, while not strict limits, signal the need for extra regulatory attention.

Regulators are telling banks to cut down their CRE loans, especially those exceeding 300% of their total risk-based capital. This means banks need bigger capital reserves, which costs them money.

Banks now ask borrowers to put up extra deposits - usually 10% of the loan amount. This means borrowers end up funding the risk-based capital requirements themselves. Private credit providers can offer better deals since they don't face these restrictions.

Rising interest rates and risk aversion

The Federal Reserve's big interest rate increases have changed how CRE lending works. CRE assets react strongly to rate changes because they're long-term investments. Higher rates can quickly lower property values, making it hard for borrowers to refinance.

Here's the tough reality: borrowers looking to refinance at current rates might need millions in extra equity just to get new financing while keeping their loan-to-value ratios steady. This explains why loan demand has dropped. Banks reported less interest in CRE loans during most quarters between 2018 and 2023.

As rates went up, lenders got stricter with their loan requirements. More banks tightened their lending standards from July 2022 through December 2023. They're being extra careful about the sector's future, which makes it harder for borrowers to get bank financing.

Banks struggle to price new loans profitably when base rates change dramatically. Many choose to wait for clearer market conditions. This cautious approach lets private credit providers jump in with flexible options.

CRE market volatility and valuation concerns

Commercial real estate has hit rough waters lately. Remote work, higher interest rates, and falling property values all play a part. CRE prices dropped about 11% from August 2022 through December 2023. The CoStar Commercial Repeat Sales Index shows an even bigger drop of 20% from its peak in July 2022.

Office buildings face the biggest challenges. Remote work is seven times more common than before the pandemic. This leads to empty offices and lower rents. The Bloomberg REIT office property index shows just how bad things are - it fell 52% from early 2022 through Q3 2023.

These market pressures affect loan performance. CRE loan delinquencies went up every quarter from July 2022 through December 2023. They hit 1.2% in December 2023 - the highest since March 2015. Late and non-performing CRE loans jumped to $28.7 billion in Q4 2023, up 72% from the start of that year.

The "maturity wall" poses another big challenge. About $1.7 trillion - nearly 30% of all CRE debt - comes due between 2024 and 2026. Borrowers will face much higher interest rates and tougher lending standards. Many might turn to private credit solutions.

Regulatory pressure, interest rate sensitivity, and market volatility explain why banks keep pulling back from CRE lending. This creates a huge opportunity for private credit to grow its market share.

What is private credit and how it fills the gap

Definition and key features of private credit

Private credit means debt-like, non-publicly traded instruments that non-bank entities provide to fund private businesses. These loans don't trade on public exchanges or appear in public markets, unlike traditional bank loans or traded bonds. The borrowers and lenders work out terms directly with each other to create customized financing solutions.

Private credit has seen remarkable growth. The global assets under management reached US$1.6 trillion in 2023. BlackRock believes this market will grow to US$3.5 trillion by 2028. This is a big deal as it means that the value could surpass today's combined US leveraged loan and high-yield markets.

Key characteristics that define private credit:

- Floating rate structure: Most loans adjust their rates with market conditions

- Senior secured position: These loans sit at the top of the capital structure and protect lenders

- Customized terms: Each borrower gets specific covenants and structures

- Limited liquidity: Lenders hold these loans until they mature instead of trading them

- Higher yields: Borrowers pay extra for flexibility and guaranteed execution

Private credit strategies range from senior secured loans to distressed situations, with different risk-return profiles. This flexibility helps private credit portfolios target various objectives based on what investors want.

Direct lending vs private credit

People often mix up "direct lending" and "private credit," but there's an important difference. Direct lending is just one strategy within private credit—though it's the biggest one.

Direct lending usually means senior secured loans to middle-market companies. This makes up about 45% of the total private credit market. Preqin data shows direct lending has grown to roughly US$800 billion in assets under management, which is about half of all private credit investments.

Direct lending forms the foundations of private credit, but the asset class now includes:

- Asset-based finance backed by specific collateral like real estate or equipment

- Specialty finance for transportation equipment, intellectual property, and royalties

- Infrastructure debt and structured finance

- Private real estate debt and distressed situations

Risk-return profiles, security types, and target borrowers set these strategies apart. Yet they share common features: customization, direct origination, and typically better yields than public market options.

Why private credit is attractive to borrowers

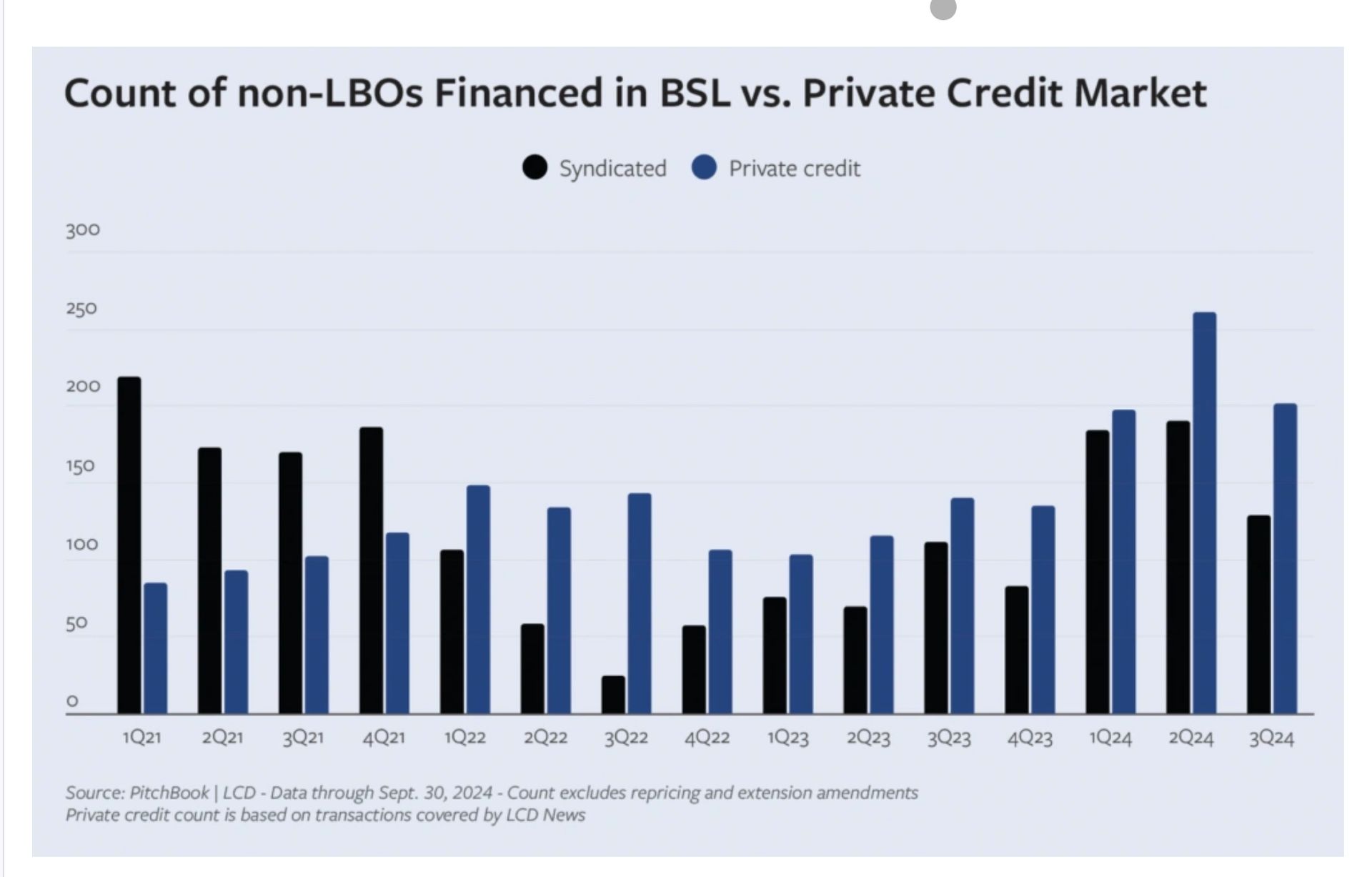

Banks have pulled back, leaving a financing gap. Private credit steps in with compelling advantages. Middle-market companies now get financing from alternative lenders rather than banks 90% of the time. Several key benefits explain this shift:

Speed and certainty of execution matter most, especially when markets are volatile. Private lenders can act fast with fewer committees and red tape. Borrowers know their deals will close when needed.

Customized loan structures give another big advantage. Private credit lenders offer flexible terms, including longer payback times and creative options like mezzanine financing, bridge loans, and hybrid deals. Companies can get capital without meeting strict banking rules.

Greater confidentiality helps companies protect their private information. They can get funding without sharing details widely, unlike in public markets.

Access to capital opens up for transitional assets or value-add strategies that banks might avoid. To name just one example, see fix-and-flip investors, developers waiting for permits, and property owners rich in equity but short on cash who find solutions through private credit.

Private credit has grown because it gives what banks can't: innovative financing solutions, personal service, and flexibility for complex funding needs. Banks continue to step back from commercial real estate, and private credit has evolved from an alternative to an essential funding source across the market.

Private credit growth in commercial real estate

Recent trends in CRE private credit deals

Private credit's growth in commercial real estate tells an amazing story. The numbers are striking - private credit assets jumped from just USD 46.00 billion in 2000 to USD 1.70 trillion by 2023. Experts predict this figure will reach USD 3.00 trillion by 2028. Real estate debt funds now make up 24.3% of all real estate fundraising.

The CRE lending market is worth about USD 6.00 trillion today. Banks keep losing their market share to alternative lenders. Even small changes make a big difference - just 1% of market share equals USD 60.00 billion in lending capacity.

These changes have helped:

- Non-bank lenders and private debt funds

- Life insurance companies looking for better returns

- Government-sponsored entities, especially in multifamily sectors

What's interesting is how this trend keeps going even when markets are shaky. While traditional lending usually pulls back during uncertain times, private credit has managed to keep growing through economic ups and downs.

Shift from banks to nonbank lenders

Banks and nonbanks provided about USD 12.00 trillion in equity and debt financing to commercial real estate in 2023. Banks still lead the pack, but they're pulling back faster than ever.

The Financial Stability Board points to three big risks for non-bank CRE investors:

Liquidity mismatches in open-ended property funds that could trigger investor runs

High financial leverage in certain REITs and property funds

Opacity in valuations of CRE assets, particularly in tough markets

These changes have created what experts call "one of the best lending environments since the post-GFC era". New capital rules now push banks to lend to nonbank lenders instead of borrowers directly - a strategy that pays off better despite smaller credit spreads.

The biggest changes show up in transitional properties and troubled sectors. Banks and insurance companies still chase trophy properties and investment-grade assets, but private credit funds step in for more complicated deals.

Examples of large-scale private credit transactions

Private credit deals in commercial real estate have hit new heights recently. Equinox Group got a USD 1.80 billion facility from private credit lenders in 2024 to refinance debt and fund new projects. This deal shows how private credit helps when traditional financing isn't available.

Park Place Technologies, a data center services company, got USD 2.00 billion from direct lenders to refinance debt and pay dividends to private equity investors. The new term loan came with a 525 basis point spread, better than their old loans that had 500 and 900 basis point spreads for first and second lien facilities.

The market's current state shows up clearly in payment-in-kind (PIK) options. In 2024, more than 9% of new private credit deals included PIK provisions. This lets borrowers pay interest with more debt instead of cash - something traditional banks rarely offer.

The pressure of maturing debt pushes many of these deals forward. About USD 950.00 billion in US commercial mortgages matured in 2024, and USD 1.70 trillion more will mature by the end of 2026. This makes borrowers turn to private credit as traditional options become harder to find.

How private credit offers flexibility banks can’t

Private credit's biggest advantage over traditional banks in commercial real estate financing is its flexibility. Borrowers benefit from this adaptability when rigid bank structures don't work for them—especially during critical investment moments.

Customized loan structures and terms

Private credit lenders create unique financing solutions that regular banks can't provide. Banks stick to standard products with little variation, while private lenders adjust every part of the loan structure based on what borrowers need. This personalization includes:

Creative payment structures with interest-only periods, step-up amortization schedules, and flexible prepayment options

Term flexibility from short-term bridge loans to 7-10 year fixed-rate structures

Collateral requirements that work with non-traditional assets or complex ownership structures

The main difference shows in how these lenders evaluate property potential. Banks look at current cash flow, but private credit can consider future performance projections. This approach helps realize the full potential of transitional or repositioning opportunities.

Faster execution and fewer covenants

Private credit moves quickly. Deals typically close in 30-45 days after term sheet approval, while traditional bank financing takes 60-90+ days or more. Small investment committees handle approvals efficiently, unlike banks' multiple approval layers.

Private credit also offers more flexible covenants. Banks enforce strict financial rules about debt service coverage ratios, loan-to-value limits, and occupancy requirements. Private credit usually provides:

Covenant-lite structures with minimal financial maintenance tests Incurrence-based covenants that only activate with specific actions Headroom in financial tests that gives more operational freedom

This quick execution proves valuable for time-sensitive deals like acquisitions with tight deadlines or rescue capital for troubled situations.

Use of mezzanine, bridge, and hybrid financing

Private credit excels in complex capital stack arrangements that banks avoid. Mezzanine financing shows this approach well—it sits between senior debt and equity, letting borrowers get higher leverage without reducing equity positions.

Bridge financing helps fill temporary gaps by providing immediate capital until permanent financing is ready. These short-term solutions (usually 12-36 months) help borrowers act on time-sensitive strategies like buying properties or refinancing mature debt.

Hybrid structures mix debt and equity features, often including profit sharing through equity kickers or conversion rights. This creates genuine partnerships instead of simple transactions.

Private credit has become essential in today's commercial real estate world because of its adaptability. It offers what banks can't—customization, speed, and creative capital solutions. The market now sees private credit as a fundamental component rather than just an alternative financing option.

Risks and challenges in the private credit market

Private credit shows rapid growth, but several challenges threaten its stability in the long run. The USD 3.00 trillion industry faces risks that need attention as it expands.

Lack of transparency and regulatory oversight

Private credit markets operate almost invisibly compared to traditional finance. Public markets provide clear visibility into borrower details, loan terms, amendments, and loan health. The private credit market lacks these features. This missing information creates several problems:

- Asset pricing depends more on assumptions than market prices you can observe - critics call this "marking to magic"

- Secondary market activity remains low, which limits price discovery

- Quarterly reports hide how fast values can drop, as Pluralsight's term loan showed when it fell 44% between March and June 2024

The Fifth US Circuit Court of Appeals overturned SEC rules that aimed to increase disclosure requirements. This highlights the tension between oversight and the industry's priorities to stay opaque.

Potential for systemic risk in downturns

Banks and private credit funds have growing connections that could make the financial system vulnerable. Boston Fed economists pointed out that "extensive connections between banks and the private credit market may be concerning, as these connections indirectly expose banks to high risks associated with private credit loans".

This setup helps bypass regulations. Banks couldn't directly offer high-leverage loans after the 2008 crisis, so they started funding private credit funds that provide such lending.

Bank loans to non-bank financial institutions, including private credit funds, reached about USD 1.20 trillion by March 2025. The banking industry could face systemic liquidity risk if many private credit lenders draw on their bank credit lines during economic stress.

Concerns over covenant-lite structures

Covenant-lite loans dominate the private credit world. These loans lack traditional financial maintenance covenants. More than 80% of leveraged loans now use covenant-lite structures. Less than 10% of loans above USD 500.00 million include maintenance covenants.

Lenders might not spot trouble without these protective measures until a payment fails or cash runs low. Their options become very limited at that point.

The evolving relationship between banks and private credit

Banks and private credit firms have evolved beyond competition into mutually beneficial collaborations. The number of major banks partnering with private credit firms jumped to 14 last year, compared to just two the previous year. This fundamental change represents a complete restructuring of commercial real estate financing.

Bank partnerships with private credit funds

Private credit providers have become valuable allies for banks. More than 100 Business Development Companies (BDCs) and closed-end funds trust U.S. Bank as their partner, with combined assets exceeding USD 65.00 billion. These alliances benefit both parties - banks keep their client relationships while reducing balance sheet exposure, and private credit firms get better access to deal flow.

Banks as originators and distributors

Banks now use several mechanisms to transfer loan ownership after origination:

- Traditional syndication expands to broader investor groups

- Forward-flow agreements establish clear paths

- Synthetic risk transfer trades create new opportunities

This strategy helps banks maintain their "last mile" client relationships while they focus on fee-based services like cash management, foreign exchange, and advisory.

Coopetition models in CRE lending

The financial sector now welcomes "coopetition" - a blend of competition and cooperation. Wells Fargo demonstrates this approach through its partnership with Centerbridge Partners, offering USD 5.00 billion in direct lending via Overland Advisors. JPMorgan Chase follows a similar path by collaborating with various private credit firms.

Basel III endgame capital requirements will likely drive these hybrid relationships to expand throughout the financial world.

Conclusion

Private credit has altered the map of commercial real estate lending in ways nobody imagined possible. What started as an alternative option has now become the go-to funding source. This change happened as banks stepped back from CRE lending.

Banks pulled back for several reasons. Regulators increased their oversight, interest rates became unpredictable, and market conditions turned volatile. These factors pushed banks to play it safe with their lending. Private credit stepped in at the right time. It gave borrowers everything banks couldn't - custom loan structures, quick execution, fewer rules, and creative ways to finance.

The growth numbers are staggering. Private credit grew from $46 billion in 2000 to $1.7 trillion by 2023. Experts believe it will reach $3 trillion by 2028. Each percentage point of market share equals about $60 billion moving away from traditional lenders.

Private credit's growth comes with its share of challenges. The market lacks transparency and might face risks during economic downturns. Many loans have fewer protective clauses, which needs careful attention as the market grows.

The relationship between banks and private credit has changed interestingly. Instead of just competing, they now work together often. Banks find and process deals while private credit provides the money. This partnership helps both sides and changes how real estate deals get funded.

Success in this new world belongs to those who can direct these changes well. Borrowers need to know all their options, both old and new. Lenders must play to their strengths. Without doubt, private credit is now a permanent force in commercial real estate finance. It will keep changing this market over the next several years.

Key Takeaways

Private credit has fundamentally transformed commercial real estate financing as banks retreat from CRE lending, creating unprecedented opportunities for alternative lenders and borrowers seeking flexible capital solutions.

• Banks are retreating due to regulatory pressure and market volatility - Tighter capital requirements, rising interest rates, and CRE market instability have pushed banks away from commercial real estate lending.

• Private credit offers unmatched flexibility and speed - Customized loan structures, faster execution (30-45 days vs 60-90+ days), and fewer covenants make private credit attractive to borrowers facing complex financing needs.

• The market has exploded from $46B to $1.7T since 2000 - Private credit is projected to reach $3 trillion by 2028, with every 1% market share shift representing $60 billion in lending capacity.

• Banks and private credit now collaborate rather than just compete - Strategic partnerships have emerged where banks originate deals while private credit provides funding, creating "coopetition" models that benefit both parties.

• Transparency and systemic risks remain key concerns - Limited disclosure, covenant-lite structures, and potential banking system exposure through credit lines pose challenges as the market continues expanding.

This shift represents more than a temporary market adjustment—it's a permanent restructuring of how commercial real estate gets financed, with private credit establishing itself as an essential funding source rather than merely an alternative option.

FAQs

Q1. What is driving the growth of private credit in commercial real estate? The growth of private credit in commercial real estate is primarily driven by banks retreating from CRE lending due to tighter regulations, rising interest rates, and market volatility. Private credit offers borrowers more flexible terms, faster execution, and customized loan structures that traditional banks can't match.

Q2. How does private credit differ from traditional bank lending? Private credit offers more customized loan structures, faster approval processes (30-45 days compared to 60-90+ days for banks), and fewer covenants. It can also provide creative financing solutions like mezzanine and bridge loans, which are often not available through traditional banking channels.

Q3. What are the potential risks associated with the rise of private credit? Key risks include lack of transparency and regulatory oversight, potential for systemic risk during economic downturns, and concerns over covenant-lite structures. The interconnectedness between banks and private credit funds also poses potential vulnerabilities to the financial system.

Q4. How are banks adapting to the rise of private credit? Many banks are forming strategic partnerships with private credit firms, acting as originators and distributors of loans while private credit provides the funding. This "coopetition" model allows banks to maintain client relationships and focus on fee-based services while reducing their balance sheet exposure.

Q5. What is the projected growth of the private credit market? The private credit market has grown from $46 billion in 2000 to $1.7 trillion in 2023. It is projected to reach $3 trillion by 2028, potentially exceeding the combined value of today's US leveraged loan and high-yield markets.