How to Handle Commercial Real Estate Debt: A Survival Guide for the $1.8T Crisis

The commercial real estate market faces a massive challenge. A whopping $2 trillion in commercial real estate debt will mature over the next three years. This isn't a minor financial hiccup—the crisis could alter the map of the entire property sector.

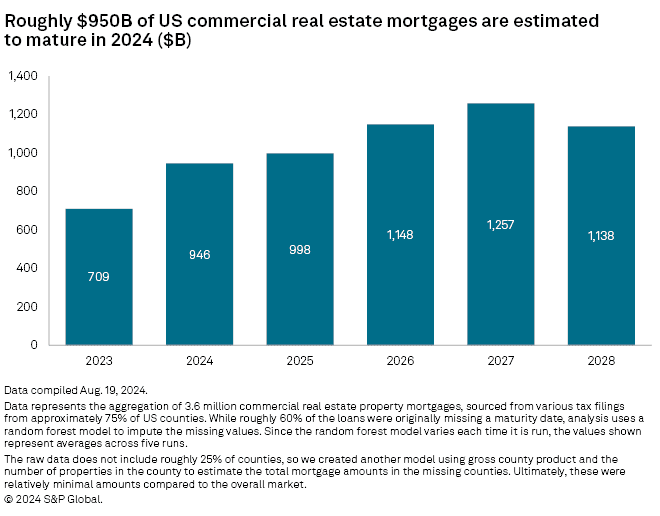

The situation grows more intense as CRE mortgages worth $950 billion will mature in 2024. Another trillion dollars will follow in 2025. The debt maturity wall ended up reaching its peak in 2027 at a staggering $1.26 trillion. From a market viewpoint, multifamily properties lead the pack with 33% of maturing loan volume.

The dramatic interest rate increase makes this situation especially concerning. CRE loans in 2024 carry a 6.2% average interest rate, compared to maturing mortgages at just 4.3%—a jump of nearly 200 basis points. On top of that, quarterly delinquency rates have climbed steadily since late 2022 and reached 1.4% in 2024's second quarter. These numbers are no match for the 2009 subprime mortgage crisis when delinquencies hit 10.2% of total CRE loans. Record-high office vacancy rates of 13.2% in 2023 and American malls' unprecedented 8.8% vacancy rate signal early warnings of potential widespread defaults.

This piece will help you direct through this treacherous commercial real estate debt environment and show you strategies to survive one of CRE history's most challenging periods.

Understanding the CRE Debt Maturity Wall

Understanding the CRE Debt Maturity Wall

What is the $1.8T maturity wall?

The commercial real estate "maturity wall" shows a massive amount of CRE loans that will come due soon. About $1.8 trillion in commercial real estate debt needs to be paid by 2026. This debt wall creates serious concerns because borrowers took these loans during the post-COVID-19 period when interest rates were extremely low. Now these borrowers face a tough choice: they must refinance at much higher rates or risk losing their properties.

The size of this maturity wall keeps growing. Recent research shows it now makes up about 27% of bank marked-to-market capital, jumping up 11 percentage points since 2020. Some experts believe this number could get even bigger, with estimates pointing to another $1.8 trillion in loans coming due between 2026-2028.

CRE loan maturities by year: 2024 to 2027

The loan maturity numbers paint a worrying picture:

- 2024: About $950 billion in CRE mortgages will come due

- 2025: CRE and multifamily mortgages worth nearly $1 trillion ($957 billion) will mature

- 2026-2027: Numbers keep climbing until they peak at $1.26 trillion in 2027

One-fifth of the $4.8 trillion outstanding commercial mortgage debt will mature in 2025. Each type of lender faces different levels of exposure. Banks will see 25% of their mortgage balances ($452 billion) mature, while CMBS/CLO mortgages hit 29% ($231 billion). Credit companies have the highest exposure with 35% of their mortgages coming due in 2025.

Why this is different from past cycles

This maturity wall stands out from previous cycles. New loans in 2024 carry a 6.2% interest rate compared to maturing mortgages at 4.3% - a jump of almost 200 basis points.

Property values have dropped, which makes getting new loans really tough. Previous decades saw interest rates steadily decrease over 40+ years, letting borrowers refinance at better terms. Today's borrowers face rates two to three times higher than in 2021.

Banks with weak capital are trying to "extend-and-pretend," which makes the maturity wall bigger instead of solving the core problems. Current delinquency rates sit at 1.4%, nowhere near the 10.2% from the 2009 crisis. Yet the sheer size and timing of these maturing loans puts enormous pressure on the market.

The Refinancing Crunch and Rate Shock

How rising interest rates affect refinancing

Interest rates have shot up rapidly, creating a severe refinancing challenge in commercial real estate. Borrowers who locked in loans at 3-4% during 2020-2021 must now deal with rates between 6.5-7.0%. This dramatic increase has doubled or tripled their financing costs. Many properties can't generate enough cash flow to meet debt servicing requirements anymore. The debt service coverage ratio could drop from 2.0 to 1.3 even for fully leased properties with stable NOI. This makes refinancing almost impossible under current lending standards.

Loan-to-value gaps and equity shortfalls

Lenders have pulled back significantly, reducing their LTV requirements from 80% to about 65%. This creates huge funding gaps when properties come due. A typical office building worth $100 million in 2019 might now be valued at just $71.2 million. A loan originally structured with 72% LTV would need $31.4 million in additional funding when refinancing. The office sector alone faces a funding gap of roughly $38 billion in 2024.

Why many borrowers face commercial real estate default

Most experts expect only 46-48% of loans maturing in 2024 will refinance successfully. Office and retail sectors show even lower refinance rates below 40%. Borrowers must contribute an extra 25-33% of existing debt as new equity to avoid default. These challenges have already surfaced—CRE loan delinquency rates climbed every quarter from July 2022 through December 2023. Distressed assets reached $116 billion in Q1 2025, showing a 31% jump from the previous year. Office properties felt the initial pressure, but stress now spreads to other sectors too.

Sector Breakdown: Office, Multifamily, and Retail

Sector Breakdown: Office, Multifamily, and Retail

The commercial property sectors show big differences in how they handle the broader debt crisis. Let's get into how each sector performs and which loan structures might be risky.

Office sector: the epicenter of distress

Office properties bear the biggest burden in the CRE debt crisis. The national office vacancy rate hit a record high of 20.4% in Q1 2025. Of course, this distress shows up in delinquency rates, and office CMBS loans reached a concerning 11.08% delinquency in June 2025. Some markets have seen property values plummet. San Francisco buildings that were worth $1,000 per square foot now sell for just $150-250. The office market surprised everyone with a 13% year-over-year rise in sales, mostly in central business districts.

Multifamily and retail: emerging cracks

The multifamily sector stays strong with record-high inventory growth. Vacancies remained stable or dropped in 40% of primary metros during Q1 2025. Multifamily properties led investment activity as sales volume grew 9% year-over-year. Retail tells a different story. Retail trade sales grew 3.3% from May 2024 to May 2025. Grocery-anchored centers did particularly well in this period.

Floating vs fixed rate loans: who's more at risk?

Floating-rate loans face more danger in today's market. About 45% of CRE loans have fixation periods under one year. This creates immediate risk when rates go up. Fixed-rate loans give borrowers stability through predictable payments. Floating-rate borrowers struggle with cash flow problems that can lead to defaults. Interest rate caps don't help much because payments can still increase significantly within capped ranges.

How Lenders and Borrowers Are Responding

Market participants have developed strategic solutions to guide them through the challenging commercial real estate debt pressure.

Loan extensions and 'pretend and extend' strategies

Banks prefer the "extend-and-pretend" approach over foreclosing troubled properties. This strategy pushes loan maturities further while banks wait for interest rates to fall and make refinancing possible. CRE loan modifications saw a sharp rise from 1.5% per quarter in late 2019 to 17% by late 2020. The trend has grown stronger, with newly modified securitized loans jumping from less than $500 million to approximately $2.5 billion between Q1 2022 and Q1 2024.

Troubled debt restructuring for commercial construction and mortgage types has tripled since 2023. The numbers reached $18 billion in Q4 2024, up from $6 billion in Q2 2023. Modified securitized loans hit a new record of $19 billion by December 2024.

Bank exposure and capital reserve tightening

Banks hold about 45% of total outstanding CRE loans on their balance sheets. This exposure has raised serious concerns among regulators. The numbers paint a clear picture: 1,788 banks have CRE exposures above 300% of capital, 1,077 exceed 400%, 504 surpass 500%, and 216 go beyond 600%. These numbers have grown since the last quarter, which shows rising concentration risk.

Banking regulators have stepped up their supervision. Banks with high CRE concentrations under increased monitoring ranged from 335 to 437 between 2018 and 2023. The year 2023 recorded the highest number. Banks have also cut back their lending activity, with volumes dropping 63% in 2023 compared to 2022.

Opportunities for investors with dry powder

The banking sector's retreat has opened doors for alternative capital sources. North America attracts 64% of the $400 billion in dry powder set aside for property investment—the highest share in 20 years. Private equity firms have stepped in as alternative lenders. Their debt funds' lending activity grew 70% year-over-year by Q3 2024.

Alternative lenders now handle 34% of closed non-agency loans, up from 27% in 2023. Banks' share has fallen to 18% from 38% a year earlier. These investors can now negotiate better loan terms, including lower loan-to-value ratios and improved protective covenants. This creates attractive opportunities in the distressed commercial real estate market.

Conclusion

The commercial real estate debt crisis is without doubt one of the biggest problems the property market has faced in recent history. Loans worth $1.8 trillion will mature through 2026, forcing both borrowers and lenders to adapt faster to this new reality.

This crisis is different from previous downturns because of an unprecedented interest rate shock. New loans now carry rates almost 200 basis points higher than maturing mortgages. On top of that, property values have declined across all types. Many owners can't bridge substantial refinancing gaps without putting in more equity.

Office properties take the hardest hit in this storm. Record-high vacancy rates and falling valuations make refinancing especially challenging when dealing with these assets. The multifamily and retail sectors show more resilience but face mounting pressure as the maturity wall peaks in 2027.

Most lenders choose "extend-and-pretend" strategies instead of forcing widespread foreclosures. This approach only delays rather than solves the mechanisms of the problem. Banking regulators have noticed and increased their scrutiny on institutions with high CRE concentrations due to growing systemic risk concerns.

This environment creates unique opportunities for investors who have capital ready to deploy, despite being tough for many stakeholders. Alternative lenders steadily fill the gap that retreating banks left behind. They secure better terms while potentially buying quality assets at distressed prices.

The commercial real estate markets will see major restructuring in coming years. Borrowers who tackle their debt problems head-on, lenders who value troubled assets realistically, and investors who deploy capital smartly have the best chance to survive—and possibly thrive—during this revolutionary period in commercial real estate.

Key Takeaways

The commercial real estate market faces an unprecedented $1.8 trillion debt crisis that requires immediate strategic action from all stakeholders.

• $1.8 trillion in CRE debt matures by 2026, with interest rates jumping from 4.3% to 6.2%—creating massive refinancing challenges for property owners.

• Office properties face the greatest distress with 20.4% vacancy rates and delinquency rates reaching 11.08%, while multifamily shows more resilience.

• Only 46-48% of maturing loans will successfully refinance, forcing borrowers to inject 25-33% additional equity or face default.

• Banks are using "extend-and-pretend" strategies rather than foreclosing, with loan modifications jumping from $500M to $2.5B between 2022-2024.

• Alternative lenders with dry powder have unprecedented opportunities, now originating 34% of non-agency loans as traditional banks retreat from the market.

This crisis differs from past cycles due to the concentrated timing of maturities and dramatic rate increases, making proactive debt restructuring and strategic capital deployment essential for survival in the evolving CRE landscape.

FAQs

Q1. What is the commercial real estate debt crisis? The commercial real estate debt crisis refers to approximately $1.8 trillion in CRE loans maturing by 2026, coupled with dramatically higher interest rates. This creates significant refinancing challenges for property owners, potentially leading to widespread defaults and market disruption.

Q2. How much commercial real estate debt is set to mature in 2025? In 2025, nearly $1 trillion ($957 billion) in commercial and multifamily mortgages are scheduled to mature. This represents about 20% of the $4.8 trillion in outstanding commercial mortgage debt.

Q3. Which commercial real estate sector is facing the most distress? The office sector is currently experiencing the most severe challenges. It has record-high vacancy rates of 20.4% and delinquency rates reaching 11.08% for office CMBS loans. Property values in some markets have plummeted dramatically.

Q4. How are lenders responding to the commercial real estate debt crisis? Many lenders, particularly banks, are employing "extend-and-pretend" strategies. This involves postponing loan maturities rather than foreclosing, hoping that market conditions will improve. Loan modifications have increased significantly, from about $500 million in Q1 2022 to $2.5 billion in Q1 2024.

Q5. Are there opportunities for investors in this challenging market? Yes, there are substantial opportunities for investors with available capital. Alternative lenders are filling the gap left by retreating banks, now originating 34% of closed non-agency loans. This allows them to negotiate more favorable terms and potentially access quality assets at distressed prices.