Hard Money Lenders vs Banks: Which Gets You Funded Faster? [2025 Guide]

Global Capital Funding Hard money lenders are transforming real estate financing by approving and funding deals in less than 14 days, while traditional banks take much longer. The speed difference can determine the success of your investment when you need to move fast on a property deal.

Hard money loans became popular after World War II and saw another surge after the 2008 US mortgage crisis. These loans could be your fastest route to funding if you have a low credit score or past bankruptcy. A hard money loan serves as a short-term financing option that offers more flexible repayment terms than standard loans.

The lending process focuses on your property's value instead of credit history. Lenders often approve up to 75% loan-to-value ratios. The quick approval and flexibility come with different conditions - repayment periods typically range from six months to several years.

This piece compares hard money and traditional loans to help you understand how each works. You'll learn which scenarios suit each option and how to pick the right financing solution for your needs in 2025.

How Hard Money Loans Work vs Traditional Bank

Hard money and traditional loans help you purchase property, but their similarities end there. The right choice for your next investment depends on understanding these key differences.

What is a Hard Money Loan?

A hard money loan represents an asset-based financing type secured by real property. Private individuals or companies, not banks, provide these loans. The concept emerged in the late 1950s as a "last resort" option for property owners seeking capital against their real estate holdings. The hard money market has expanded substantially since the 2009 mortgage crisis and subsequent Dodd-Frank Act due to stricter regulations on traditional lenders.

The industry now moves away from the term "hard money." The National Private Lenders Association encourages alternatives like "private lending," "bridge lending," and "transitional lending".

How Does a Hard Money Loan Work?

The property's value, not your financial profile, determines the fundamental structure of a hard money loan. Lenders calculate the loan amount using the loan-to-value (LTV) ratio and typically lend 65-75% of the property's current value. They establish this value through a broker price opinion or an independent appraisal.

These loans close quickly—sometimes in just 3-5 business days—because they prioritize collateral over creditworthiness. The speed comes with interest rates from 8% to 15%, and loan terms usually last six months to three years.

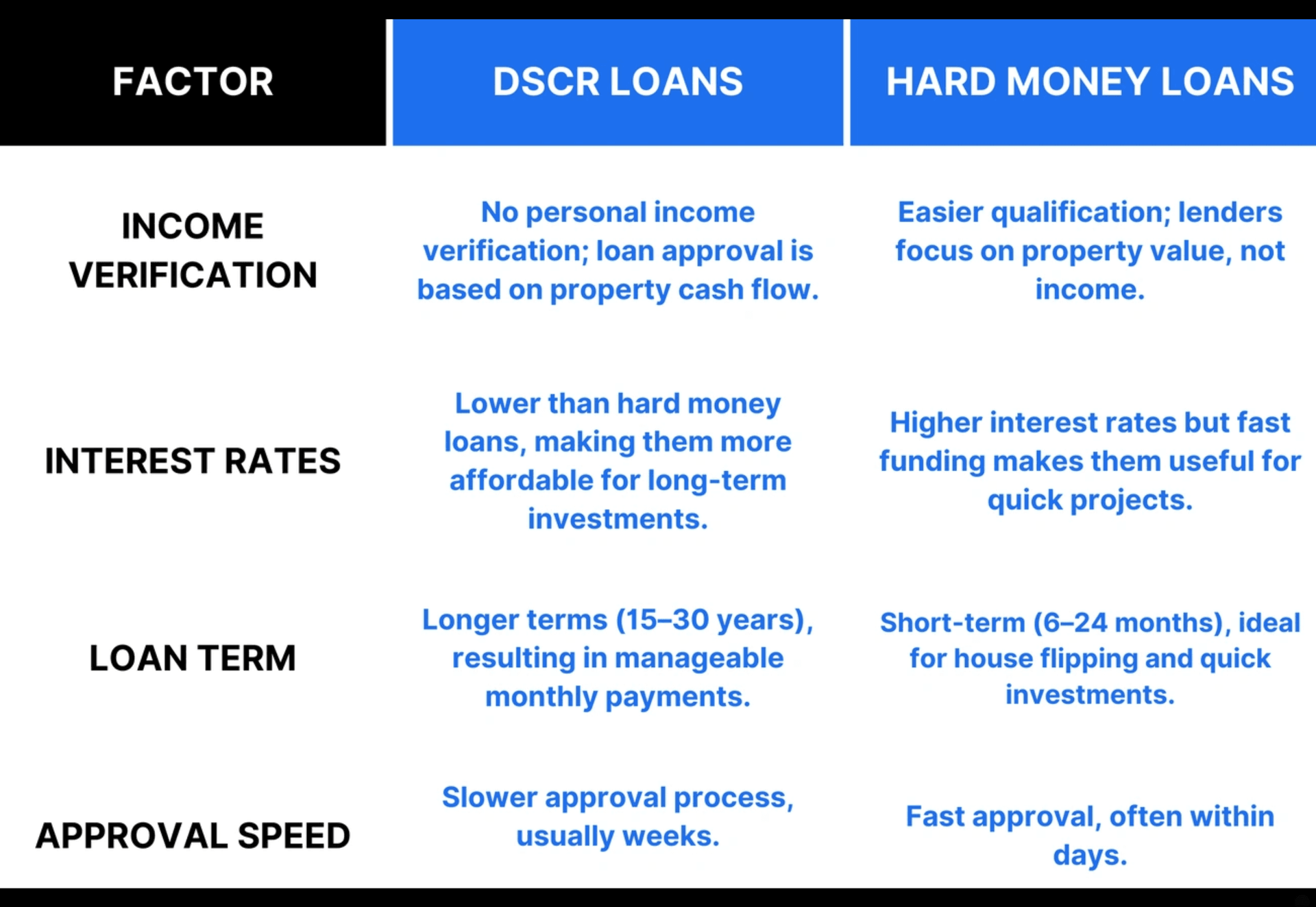

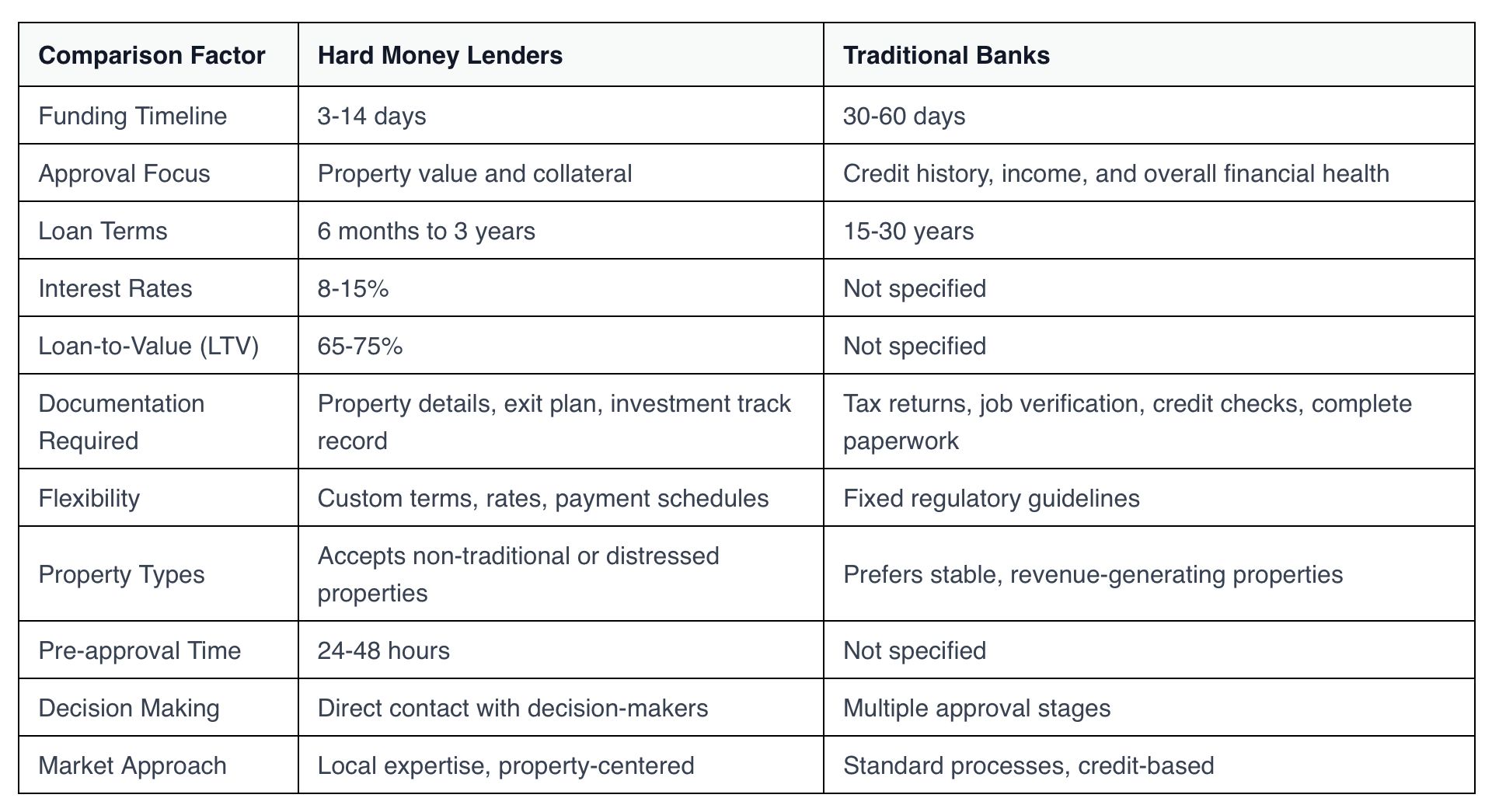

Hard Money vs Traditional Loan: Key Differences

These financing options differ in several important ways:

Approval Focus: Hard money lenders inspect the property's current and potential value. Traditional lenders assess your credit history, income, and overall financial situation.

Timeline: Traditional bank loans need 30-60 days to close. Hard money loans can fund within 5-14 days.

Documentation: Banks need extensive paperwork including tax returns, employment verification, and credit checks. Hard money lenders focus on property details, your exit strategy, and relevant investing experience.

Terms: Traditional mortgages offer 15-30 year financing, making them ideal for residential homebuyers. Hard money loans serve short-term needs, especially for investors pursuing fix-and-flip projects, bridge financing, or construction loans.

Flexibility: Hard money lenders customize terms to match your project's needs, including interest rates, repayment schedules, and loan duration.

Speed and Flexibility in Real Estate

Funding Timeline: 7 Days vs 45+ Days

The speed gap between funding options tells a clear story. Hard money lenders wrap up everything from application to funding in 5-7 business days. Traditional bank loans take much longer - usually 30-60 days and sometimes over 45 days to close. This timing becomes a vital factor when investors chase opportunities in auctions or competitive markets.

Loan Customization: Private Lenders vs Institutional Policies

Private lenders give you more room to maneuver than banks. Banks must stick to strict regulatory frameworks, but hard money lenders can shape loan structures around your project's specific needs. You can negotiate everything from interest rates to repayment schedules and loan duration based on your property type and investment strategy.

Pre-Approval and Closing Process Comparison

The pre-qualification approach is different between these options. Hard money pre-approvals happen quickly - usually within 24-48 hours. They focus mainly on what the property is worth. Traditional lenders need a stack of paperwork including tax returns, proof of employment, and credit checks. Small hiccups that could hold up a bank loan - like title issues or missing documents - rarely slow down hard money closings.

Borrower Scenarios and Risk Tolerance

People seek hard money financing for different reasons based on what they need and how quickly they need it. Let's get into who gets the most value from these loans.

Hard Money Lenders for Real Estate Investors

Real estate investors use hard money loans when they need quick cash for short-term projects. These loans work great for fix-and-flip deals where investors buy, fix up, and sell properties fast. On top of that, property developers use these loans for construction and renovation projects that regular banks might see as too risky. Investors who compete in hot markets gain a big edge by making what amounts to "cash offers".

Hard Money Lenders for Business Acquisition

Business buyers who need to move fast often turn to hard money financing. These loans get approved quick - usually within 48 to 72 hours - so buyers can grab opportunities before someone else does. The interest rates run from 10% to 15%, but buyers think it's worth paying more when they need money right away. These asset-based loans are a great way to get started especially when you have first-time business buyers or corporate professionals without much lending history.

SBA Loan vs Bridge Loan: When to Choose What

Your choice between SBA and bridge loans comes down to speed versus cost. Bridge loans fund in 24-72 hours while SBA loans take 30-45 days. SBA loans give you much better terms - rates around 6.5% for 10-25 years compared to bridge loans at 9%+ for just a few months to three years. Bridge financing makes sense for seasonal needs, emergency equipment replacement, or quick market opportunities. SBA loans work better when you want to build lasting competitive advantages with stable, cheaper capital.

Lender Types and Market Expertise

Commercial Hard Money Lenders vs Banks

Commercial hard money lenders run smaller, more personal operations. Borrowers work directly with decision-makers, which creates a level of personalized attention you won't find at bigger institutions. Banks focus on conventional properties and reject up to 43% of commercial loan applications. Hard money lenders have no problem financing non-traditional or distressed properties. Banks, on the other hand, stick to stabilized, income-producing buildings that meet their strict criteria.

Underwriting Approach: Common Sense vs Credit Metrics

These two lender types evaluate deals in completely different ways. Hard money lenders look at property value and project economics instead of strict personal financial requirements. They take a "common sense" approach and look beyond standard lending metrics to understand your specific situation. Banks follow standardized procedures and focus on credit scores, debt ratios, and extensive financial documentation. They rarely make exceptions, even for properties with great potential.

Local Market Knowledge and Decision-Making Speed

Local expertise makes funding happen faster. Hard money lenders who know their region can visit properties within 24 hours. Their deep understanding of local markets leads to more accurate valuations and better investment guidance. This local knowledge helps them spot good investments that algorithms might overlook. Face-to-face relationships with decision-makers cut through red tape and eliminate delays that come with third-party property inspections.

Conclusion

The difference between hard money lenders and traditional banks becomes clear when you need quick funding. Hard money loans move much faster than bank financing. You can get your money in 3-14 days with hard money lenders, while banks typically take 30-60 days.

Your specific situation and priorities will help you choose between these options. Hard money loans work best when speed matters more than long-term costs. These loans help fix-and-flip investors, property developers with tight deadlines, and business buyers who need capital quickly. They're also valuable to borrowers with less-than-perfect credit or those buying non-traditional properties.

Bank loans make more sense for long-term financing needs. Lower interest rates and longer repayment periods suit primary homes or stable commercial properties that serve as long-term investments.

The best choice depends on your investment strategy, time constraints, and comfort with risk. Smart real estate professionals often use both types of financing. They might start with hard money to buy and renovate quickly, then switch to conventional financing once the property stabilizes.

Knowing these differences helps you pick the right financing path for your project's needs and investment goals. The ever-changing real estate market offers options that match your priorities - whether you need speed and flexibility or prefer lower costs over time.

Still unsure which path is right for your specific project? Our loan experts can analyze your deal and give you a clear, no-obligation funding plan in under 15 minutes.

Key Takeaways

When choosing between hard money lenders and banks, speed and project type determine the best financing option for your real estate investment needs.

• Hard money lenders fund deals in 3-14 days versus banks' 30-60 day timeline, making them ideal for time-sensitive opportunities • Hard money loans focus on property value (65-75% LTV) rather than credit scores, helping investors with imperfect financial histories • Interest rates are higher (8-15%) but terms are flexible and customizable based on specific project requirements • Banks offer better long-term rates for stabilized properties, while hard money excels for fix-and-flip and distressed properties • Successful investors often use both strategically: hard money for quick acquisition, then refinance through conventional lenders

The key is matching your financing choice to your timeline, property type, and investment strategy rather than viewing these options as mutually exclusive.

FAQs

Q1. What is the main difference between hard money loans and traditional bank loans? Hard money loans focus primarily on the property's value and can be approved within days, while traditional bank loans evaluate the borrower's creditworthiness and typically take 30-60 days to process.

Q2. Are hard money loans suitable for long-term real estate investments? Hard money loans are generally not ideal for long-term investments. They are best suited for short-term projects like fix-and-flip properties or bridge financing, with terms usually ranging from 6 months to 3 years.

Q3. How do interest rates compare between hard money lenders and banks? Hard money loans typically have higher interest rates, ranging from 8% to 15%, compared to traditional bank loans. However, they offer faster approval and more flexible terms.

Q4. Can I get a hard money loan with a low credit score? Yes, it's possible to obtain a hard money loan with a low credit score. Hard money lenders focus more on the property's value rather than the borrower's credit history, making them a viable option for those with less-than-perfect credit.

Q5. What types of properties do hard money lenders typically finance? Hard money lenders are often willing to finance a wide range of properties, including non-traditional and distressed properties. This flexibility makes them attractive to investors dealing with properties that might not meet strict bank criteria.

Stop waiting on bank delays. Global Capital Funding specializes in closing commercial loans in as little as 10 business days. If you have a deal-ready property and need capital fast, your timeline is our priority.